On March 8, 2021, the WV Farm Bureau held a public meeting to discuss the Forced Pooling Bill SB 538/HB 2853now being considered by the WV State Leglislature.

Dwayne O’Dell, from the WV Farm Bureau made the introductions of the speakers which included: Valerie Antonette (Bounty Minerals) explained SB 538 and HB 2853; Tom Huber (President, WV Royalty Owners’s Asssociation, explained why this Billis bad for Property Owners; and Robert Pierson (President, NARO) spoke to the policy position.

West Virginia Royalty Owner’s Association SB 538/HB 2853 Position

This is a forced pooling bill modeled after Ohio’s forced pooling law. It allows operators to force in the owners of up to 35 percent of the net acreage of the proposed unit for shallow horizontal wells. There is no requirement that the operator negotiates with the non-consenting royalty owners prior to getting a hearing or unitization order, only that they provide an affidavit saying they attempted to. Unitization in the context of this bill is a term used for what has been for decades called forced pooling.

Key provisions of this bill are that non-consenting royalty owners will receive a 12.5 percent royalty. However, unlike the current forced pooling law in WV for deep wells, it is set at 12.5 percent, whereas for deep wells the Oil and Gas Conservation Commission can set a higher royalty if they deem it fair. Also, unlike the Co-Tenancy Bill passed three years ago, which grants a royalty equal to the highest royalty of consenting co-tenants paid without post-production deductions, this bill does not require royalties to be paid on the sale of the gas to a third-party purchaser or free of post-production deductions. This is important because operators use a subsidiary company to pay royalties on a price they create using the new back method, which is a fancy way to say a price that takes deductions without calling it deductions. This is fraud in my opinion, but it may be a legal work around no deduction leases that has yet to be ruled on by the WVSC. I highly doubt operators will offer more than 12.5 percent if this bill passes, whereas now in some places 20 percent royalties are not uncommon.

Upfront payments for an oil and gas lease range anywhere from $1000.00 to $7000.00 per net acre depending on the location and price of gas in the open market right now. These “bonus” payments range up and down also as a function of lease terms where some owners take less up front, closer to 1000 or 2000 an acre, for the benefit of certain lease terms or royalty percentage. This legislation gives the non-consenting owner no upfront money for the lease it forces on the mineral owner. In the opinion of West Virginia Royalty Owner’s Association, this would constitute a taking of property without compensation, which violates the WV Constitution. In the Co-Tenancy Modernization Act, which WVROA supported, non-consenting co-tenants received an average payment of the consenting co-tenants.

The threshold for pooling in this bill is 65 percent, which is less than the 75 percent from co-tenancy. Remember, co-tenants are co-owners, which is very different than this bill that addresses neighboring property owners that own their property in their own right.

The bill requires the operator to propose a lease with their application, and those lease terms will be what the non-consenting owners are subject to if the Commission decides they are just and reasonable based on the terms of other leases in the unit. But it should be noted the companies are not required to provide the commission with the actual leases from consenting co-tenants, only a list of co-tenants they have leased. This is very bad, as that lease could have no shut-in provision, mandatory arbitration, no Pugh clause, no liability shield, among many other provisions that are disadvantageous to royalty owners.

The non-consenting owner can elect to participate in the well, which is where they own their proportionate share of the well and pay their share of drilling and operating the well. They can also participate on a carried basis where their share of the costs comes out of their production but at a 300 percent penalty, meaning they pay the share of costs three times over. These provisions are different than the deep well forced pooling we already have which is a 200 percent or double costs.

Pooling orders under this bill last 3 years, unless extended by the Commission or drilled.

Any Appeal is to the Kanawha County Circuit Court, when it should be the Circuit Court of the county where the property is located.

It is the position of the West Virginia Royalty Owner’s Association that the bill is one of the worst forced pooling bills we have ever seen. There is no protection for mineral owners; in fact, it opens a door for operators to get around protections elsewhere in the code. We recognize there are competing correlative rights and a public policy need to prevent waste, and over the years we have supported reforms such as the Co-Tenancy Modernization Act because it balanced these needs with the property rights of the non-consenting owner. Co-Tenancy Modernization did an excellent job of protecting the ability of owners to engage in good faith negotiations in the free market to obtain a good lease for their property. SB 538 and HB 2853 puts a gun to the head of the mineral owner to accept whatever lease is offered or be force pooled and get nothing. This is not about preventing waste, or protecting correlative rights; it is about driving down royalties and payments to mineral owners and landowners to profit large horizontal drilling companies’ bottom line. It is nothing but legalizing theft.

Farm Bureau’s Proposed Changes to SB 538/HB 2853

1. Require information regarding operator’s actions to show reasonable good faith negotiations with all executive interest owners prior to submission of the application to the OGCC and empower it to dismiss applications that they decide do not meet a reasonable and good faith effort.

2. Raise the threshold from 65% to 75% to be the same threshold as in the Co-Tenancy Act.

3. Limit the size of units to 640 acres.

4. Add a mineral owner member to the OGCC who is not affiliated with or has been employed or paid by an operator as a subcontractor for at least 5 years.

5. Include in the public policy declaration royalties paid in the state of WV be done without post-production costs and calculated at the first sale that is an arm’s length transaction to an unaffiliated third-party purchaser.

6. Require information regarding the operator’s actions to locate unknown and unlocatable interest owners of the tracts or portions of tracts sought to be included in the unit.

7. Require non-consenting owners be paid a bonus equal to the highest paid bonus of the consenting owners within the unit.

8. Require non-consenting owners be paid a royalty rate equal to the highest royalty rate of the consenting owners and be without post-production cost and calculated at the first sale that is an arm’s length transaction to an unaffiliated third-party purchaser.

9. Lower the risk penalty for those that elect a carried interest to 150%.

10. Prohibit binding arbitration clauses, storage clauses, and schedule of payment clauses that do not conform with § 37C-1-1, § 37C-1-2, § 37C-1-3.

11. Require shut-in royalty clauses with shut-in payments and terms being the most favorable among the consenting owners of the unit.

12. Require the lease provided by the operator for use with the non-consenting owners contain a liability shield for the non-consenting owner.

13. Require the lease provided by the operator for use with the non-consenting owners contain a provision that sets aside monies for the full cost of reclamation of the well should the operator go bankrupt or abandon the well so that the non-consenting owner cannot be required to do reclamation of the abandoned well in the future.

14. Require an auditing provision that allows the non-consenting owner to audit the operator once every three years at the cost of the non-consenting owner.

15. The leased threshold requirement (65%) will only apply to leases executed after the effective date of the statute.

16. Must explicitly state that all surface use for operations in the unit require a surface use agreement from the owner of the surface.

17. Require unit orders must only apply to the target geologic formation.

WV Gas Facts

1. According to the EIA (Energy Information Administration), in 2009 West Virginia produced 264,436 MMcf (million million cubic feet) of natural gas. In 2019 West Virginia produced 2,155,757 MMcf of gas. In just one decade WV gas production is up 800 percent, and the EIA estimates 2020 production to 2,592,429 MMcf, which is a massive increase of 436,672 MMcf in a year of record low gas prices.

2. EIA estimates that Ohio production will fall from 2,654,186 MMcf in 2019 to 2,408,741 MMcf for 2020, and Pennsylvania production will grow from 6,896,792 MMcf in 2019 to 7,288,562 MMcf in 2020, which is not only a slower rate of growth than West Virginia but is also smaller growth in actual MMcf.

3. According to the EIA, West Virginia produced more NGLs (natural gas liquids) at 132,355 barrels from its gas than its neighbors Ohio, which produced 36,551 barrels, and Pennsylvania, which produced 65,363 barrels.

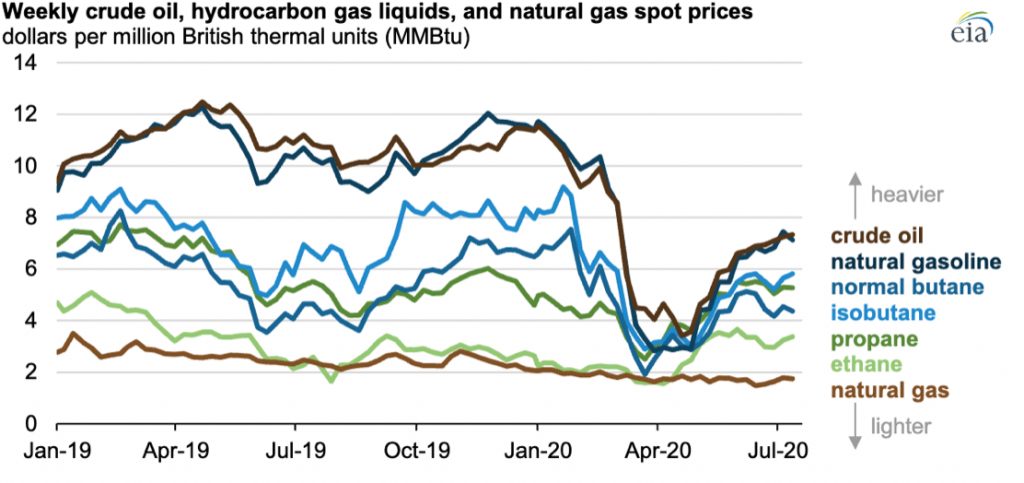

4. NGLs – butane, isobutane, propane, and ethane – command a higher price per Btu (British thermal unit) equivalent. This means when compared on an equal Btu value, NGLs have a higher price than methane as illustrated in this EIA graph.

5. Even when methane prices are consistently low in the basin, WV gas still attracts development due to its high NGL content.

6. Paying royalties or taxes on NGLs based on the price of methane is a way to hide money from the royalty owner or the government. It would be as if any oil produced was paid at the methane price rather than the oil price.

7. According to Baker-Hughes, West Virginia had 12 active rigs in February of 2021, compared to 7 in Ohio and 18 in Pennsylvania.

Please give your Delegates and Senators a call along with Bill Anderson (Chairman House Energy Committee) (304)340-3168; Roger Hanshaw (House Speaker) (304) 340-3210; Craig Blair (President of the Senate) (304)357-7801 and Randy Smith (Chairman Eenergy Committee — Senate).